Commercial Property Assessed Clean Energy, or C-PACE, is a simple and affordable tool that provides long-term, low-cost financing for qualified efficiency improvements to commercial buildings. The program is authorized by the state of Texas and implemented by counties and cities.

Eligible upgrades are repaid through a voluntary assessment that is attached to the property, typically over a term of 20-30 years. C-PACE improvements add value to the property by reducing utility bills, and in some cases the upgrades outweigh the cost of the improvements themselves.

Advantages of C-PACE Financing

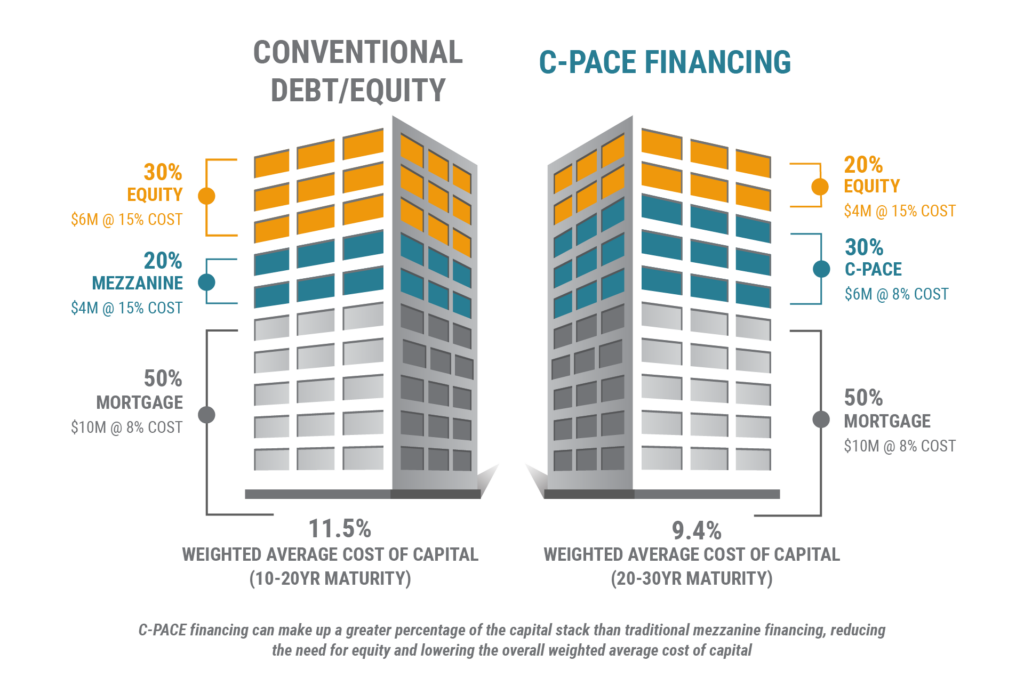

C-PACE improves capital efficiency, enhances cash flow and reduces financing risk.

Incorporating C-PACE financing in a project tends to lower the weighted average cost of capital, extend average maturity dates, and improve cash flow and debt-service coverage ratios.

Which Project Types Are Eligible For C-PACE?

C-PACE financing can be applied to projects in various phases of the development lifecycle. Renewable energy improvements are also eligible.

Questions about

C-PACE?

Connect with our team

"*" indicates required fields